In 2016, the market capitalization of Bitcoin came to more than 10 billion USD, demonstrating that planning and keeping up a disseminated cryptographic money is in fact doable today. In spite of the fact that the specialized primitives, which are basically cryptographic hash capacities, and uneven cryptography have existed for some time, Bitcoin was the first idea to consolidate these specialized building obstructs with a motivator framework, in this manner making the first conveyed cryptographic cash ever. It can possibly upset the monetary administrations industry — changing how we exchange money related securities, wiping out the postponements and wire charges that go with worldwide installments, opening bank records to the simple examination of controllers and the general population,

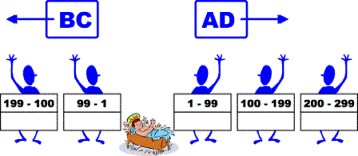

Cryptographic forms of money depend on two different sorts of information structures: exchanges and pieces. Exchanges are assembled together in pieces. The squares are affixed together by means of hashes of their forerunners, in this manner framing a verified information structure, the piece chain. Exchanges and pieces are scattered among every single partaking hub utilizing a tattling convention over a shared (P2P) organize.

The blockchain varies from customary databases in a couple of vital ways. Rather than putting away information in one focal area, it appropriates it among a system of clients running the bitcoin programming. An entire history of each bitcoin exchange is put away on the blockchain, and these recorded exchanges are available to open investigation.

Before a bitcoin exchange is affirmed and handled by the system, it is confirmed utilizing a cryptographic calculation that checks the exchange against the histories put away on each PC in the system. This procedure is mind boggling, yet it has one major favorable position: it makes the blockchain exceptionally hard to hack, advocates say.

Built up organizations are occupied with the blockchain in light of the fact that it can clear exchanges in a split second and wipe out go-betweens from money related exchanges, while offering the two gatherings a high level of straightforwardness and security.

A few devotees imagine a world in which forms of the blockchain — or some other blockchain-enlivened convention, yet based on a one of a kind establishment — will turn into the all inclusive convention that supports our whole monetary framework.

In addition, there exist numerous ways to deal with decay digital currency innovations. The operation most digital currencies can be separated into two primary segments: (I) Consensus administration incorporates everything that is accord pertinent, e.g., agreement calculations and correspondence viewpoints. (II) Digital resource administration alludes to all applications that expand upon the concurred state and follow up on it, e.g., key and exchange administration. For a more fine-grained partition, both principle segments can be separated into numerous subsystems.

In spite of these momentous accomplishments, there are likewise many difficulties and issues left to determine. These difficulties, which most cryptographic monetary standards are confronting today, are not exclusively of a specialized sort. Vast databases can require an enormous measure of registering energy to work proficiently. Commonly, that power originates from a gathering of servers put away in a distribution center some place.

The security and properties gave by Bitcoin and its subordinates are a blend of specialized viewpoints, for example, cryptographic primitives and accord calculations and also motivation designing that depends on mining rewards, and the trust individuals put in the digital currency, e.g., that bitcoins have and will hold their esteem. The difficulties related with digital currencies are versatility, asset utilization, centralization versus Decentralization, updatability, coin administration and convenience, recuperation and safe stockpiling.